The Australian Securities and Investments Commission (ASIC) has issued new guidelines that restrict Aussie influencers from providing financial advice without an Australian Financial Services (AFS) licence.

An AFS licence is a regulatory measure set by the Australian Federal Government that seeks to protect consumers, investors and creditors where their finances are concerned.

This licence usually affects those working in financial services. However, ‘finfluencers’ and influencers who discuss financial products and services online are now having to adhere to these measures too.

What is a ‘finfluencer’?

A financial influencer who creates content that discusses financial products and services. They also offer financial advice and tips to their audience. They’re generally known for having a more mature-aged audience, but have become increasingly popular among younger social users.

According to ASIC’s 2021 young people and money survey, 33% of 18-21 year olds follow at least one finfluencer and a further 64% of young people reported changing at least one of their financial behaviours as a result of following a finfluencer.

Money-aware social users are seeking advice from these types of influencers, but up until this point, this market has been largely unregulated.

With the significant power they hold to influence social users of all ages, influencers must now comply with financial service laws or face penalties, as per ASIC’s new ruling. In this guide, we share what this new ruling means, how it might affect you, and everything else Aussie influencers should know before sharing their next post.

What is ASIC’s new ruling?

The new regulation states that influencers cannot provide financial product advice or arrange for their followers to deal in a financial product (dealing by arranging) without having an AFS licence.

Essentially, they come under the same scrutiny that a professional financial advisor would. On top of that, ASIC reiterates you must only post content that is accurate and balanced. If your posts are misleading or deceptive, you may be breaking the law.

What is considered financial product advice?

As per ASIC’s information sheet:

“Financial product advice is a recommendation or statement of opinion which is intended to influence, or which could reasonably be regarded as being intended to influence, a person making a decision in relation to financial products.”

ASIC also states that, “If you’re an influencer who receives benefits or payment for your comments in relation to financial products, you’re more likely to be providing financial product advice, because it indicates an intention to influence the audience.”

For example, sharing a post that says, ‘’I’m going to share with you five long-term stocks that will do well, which you should buy and hold’ is considered to be financial product advice, as you’re providing an opinion about these products and intending to influence someone’s decision to buy specific financial products.

Read more of ASIC’s case studies to help you determine when different social posts are considered to be providing financial product advice.

What is considered as ‘dealing by arranging’?

Following ASIC’s information sheet, ‘dealing by arranging’ means:

“Arranging for a person to deal in a financial product, such as buying or selling a financial product, is a financial service. Whether you are arranging for someone to deal in a financial product will depend on the extent of your involvement in making the transaction happen.”

For example, promoting an affiliate link to a trading platform in which you receive a payment for each click-through, and people that access the link also receive a benefit when buying the products because of your link, would make you actively involved in making a transaction happen. This would therefore be considered as ‘dealing by arranging’.

Read more of ASIC’s case studies to help you determine when different social posts are considered to be ‘dealing by arranging’.

What is considered as misleading or deceptive content?

ASIC states, “The law prohibits conduct that is misleading or deceptive, or likely to mislead or deceive, in relation to financial products or services. Any statement you make should be true, accurate, and able to be substantiated.”

For example, if you tell your followers, “Holding onto this share in the long term will generate significant returns and is just like depositing your money with a bank”, you are sharing misleading content because:

- It is unlikely the ‘significant returns’ claim can be substantiated.

- The potential product risks aren’t explained or highlighted.

- And it gives the impression the product is safe like a bank, which may not be true.

Read more of ASIC’s case studies to help you determine when different social posts are considered to be ‘misleading or deceptive’.

How do I know if I need an AFS licence?

If you’re creating content that provides financial services, such as providing financial product advice or dealing by arranging (both explained above), then you are required to get an AFS licence to continue creating this type of content.

An AFS licence authorises you to provide financial services to your social audience. You can learn more about how to obtain an AFS licence via the official ASIC page for financial service providers.

What can I still talk about without an AFS licence?

Don’t fret. Influencers around the country won’t need to pack up shop and delete all their social media accounts. According to ASIC’s executive director, Greg Yanco, “The safe areas are providing information about what a share is and the different types of investments you can make, without going to the stage of suggesting particular types of shares or investments.”

ASIC’s information sheet also states you can share the following without an AFS licence:

- Factual information that describes the features or terms and conditions of a financial product (or a class of financial products) without giving financial product advice on whether or not someone should invest in that product or class of product.

- Descriptions of different types of financial products, with no implied recommendation that one is better than another.

- Tips on saving money and budgeting that don’t involve financial products.

- The names and details of AFS licensees who are authorised to trade financial products.

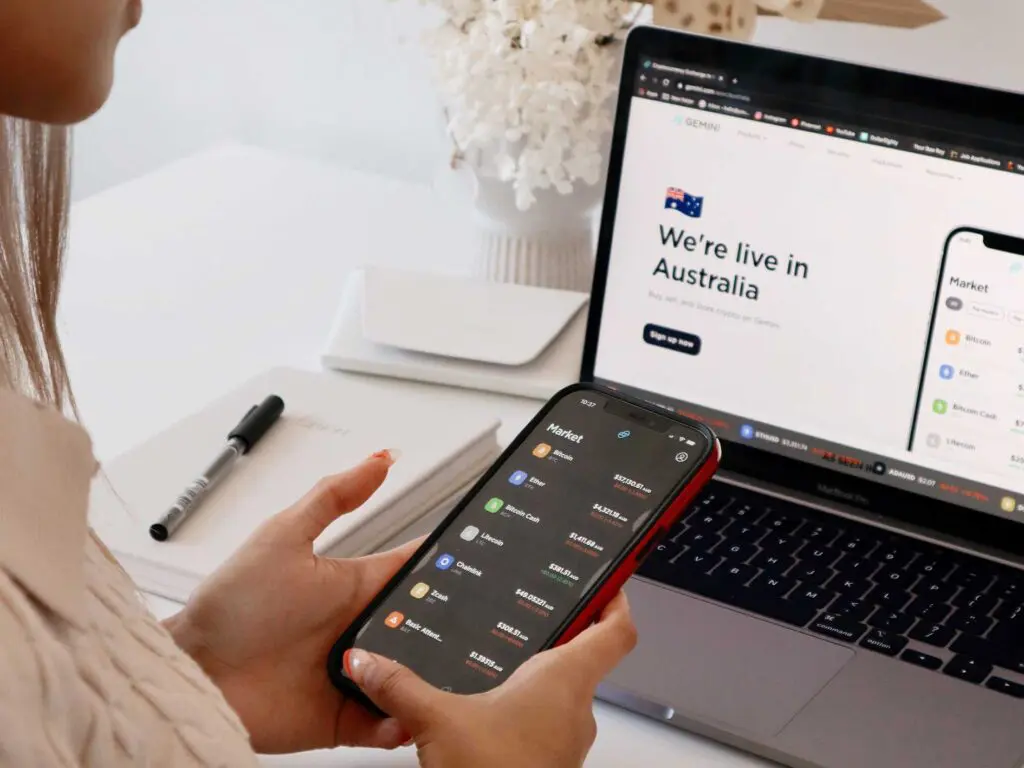

And if your specialty is cryptocurrency, you’re in luck. Influencers can still speak about cryptocurrencies to their audience according to Yanco, who says, “At the moment, ASIC is not able to regulate crypto assets that are not financial products.”

How does this new ruling affect brand collaborations?

If you’ve read this far down, you might be starting to panic. We’ve relayed a lot of serious legal information in a short space of time. But don’t stress. Many Australian brands, marketers, and influencers are in the same boat, and navigating these new regulations isn’t as scary as it seems.

Let’s unpack what the new rules actually mean for each party in terms of brand collaborations:

If you’re an influencer:

The main takeaway is that you can no longer provide financial advice without an AFS licence. If you’re being paid, or gain benefit from providing financial advice to your followers, you will need to consider getting an AFS licence, or change how you present your content.

This might mean that you shift from promoting financial products to giving more general ‘money saving’ tips. You may also need to reconsider promoting affiliate links where you and the people accessing the link receive benefits. Use this ASIC guide to better understand how to legally promote financial products and services.

And if you’re serious about continuing to offer financial advice, you may consider becoming AFS qualified. Use this ASIC guide to apply for an AFS licence.

If you’re a brand:

You need to be much more intentional with the creators that you partner with. Ideally, brands that are wanting to promote financial products or services should seek to work with influencers that have an AFS licence.

This will allow you to partner with creators to share financial product advice and arrange for your followers to deal in a financial product (dealing by arranging). Naturally, these highly qualified influencers are harder to find, so you may need to use an influencer platform like Vamp to check their credentials.

If that’s not the path you want to take, you will need to adjust the content you’re promoting. For example, you may collaborate with influencers to share their personal money stories, or open the conversation about financial wellness or the investment gap between different demographic groups.

Use the ASIC checklist guide under ‘AFS licensees who use influencers’ before engaging with influencers.

If you’re a marketer:

It’s vital to do your research before partnering with creators. While creators can come under legal scrutiny for providing advice when they’re not AFS licensed, brands can likely face more intense fines and legal backlash from campaigns providing unlicensed financial advice.

Do your research and be sure to check a creator’s qualifications before engaging with them. You can use this ASIC resource to read up on AFS regulations.

You may also want to run the numbers and check out your creator’s following. Do they have the kind of audience you want to target? Has the creator’s audience grown organically? Do they have a strong enough engagement rate?

Using a platform like Vamp will help you iron out any inconsistencies, and find the most highly compatible creators for your campaign.